Editor's note: The following sponsored content was provided by Educators Credit Union.

As criminals introduce new and creative ways to commit fraud, financial institutions' main priority is protecting you and your finances.

In this article, you will read stories from unsuspecting victims, learn how to recognize the warning signs of a scam and receive information on how to protect yourself from these scams. We hope this piece gives you valuable information to help you and your loved ones from becoming victims of fraud.

Is it a scam?

Here are seven questions to help you. If you answer yes to any of these questions, it’s likely a scam.

- Were you asked to lie or hide information from your financial institution?

- Were you contacted unexpectedly about a payment, delivery or charge you didn’t know about?

- Did someone call, email or text you asking for your username and password to online banking?

- Were you asked to wire money or buy gift cards?

- Did someone ask you to send back extra money because they overpaid you?

- Were you promised quick or easy money?

- Were any of the requests above presented as urgent or threatening?

And here are seven tips to keep your accounts and personal information safe.

- Never send or give anyone your online banking username and password. There is no reason why anyone would ever need your login credentials to access your accounts.

- Only log in from your financial institution's mobile banking app or directly on the official website.

- Never act immediately. Any legitimate business will never pressure you. Instead, they will allow you to decide when you’re ready.

- Keep your electronic devices up to date with the latest software updates.

- Don’t send money back to someone who “accidentally” sent you money via digital payment.

- Use strong passwords. A strong password is long and memorable, since longer passwords are harder for hackers to break. For instance, a password can be a long phrase with a mix of numbers and symbols. It’s also essential to change your important passwords every three months and to not reuse passwords.

- Verify, verify, verify. If you receive an email, text message or phone call, verify it’s from a trusted source.

1. Text message scam

It started with a text asking if Taylor spent $1,532 at Target.

Believing the text was from his credit union, he responded “NO.” Then, his phone rang.

"The woman on the phone told me the text was for fraud prevention," Taylor said. "She told me that she could help if I immediately gave her my username and password for online banking.”

Taylor followed these instructions. He believed she was reversing the fraudulent Target payment when in fact it was just the opposite.

“That’s where the scam was,” he said. “She took all the money out of my account. It was gone.”

Here’s how to identify this scam: The person contacting Taylor about his account was pushy, and they insisted there was no other way to fix the problem besides following their instructions.

Here’s how to protect yourself from this scam:

- Never discuss account numbers, PINs, passwords or other personal information with anyone who contacts you. Legitimate companies don't ask for information like your account numbers or passwords by email, phone or text.

- Don’t call phone numbers sent in texts, emails or voicemails, as it will connect you with the scammers. Instead, call your financial institution directly and check whether the email, text or voicemail is from them.

- Don't trust caller ID. Just because your caller ID displays a phone number or name of a legitimate company you might recognize, it doesn't guarantee the call is really coming from that number or company. Forward fraudulent texts to your wireless service provider at 7726 or “SPAM.”

- Don't click on links provided in text messages from numbers you don’t recognize. Links can install malware and take you to fake websites that look real but whose purpose is to steal your information.

2. Dating and romance scam

One day, Isabella received a Facebook friend request from "Ivan Miller."

She decided to accept the request. He messaged her and said he was looking for friends to keep him company while he was on military duty overseas. A few weeks after befriending her, a romance started.

“He kept saying he couldn’t wait for us to get married,” Isabella said. “We became very close, and he emailed me every day because it was easier for him than using Facebook.”

Ivan told her that he had some trouble with his credit card and couldn’t get funds to pay for a plane ticket to visit her. Isabella sent him $5,000 in gift cards to cover the plane ticket and some extra expenses until his credit card situation was figured out.

Then, he said his mother was sick and needed money for surgery and as soon as he paid the surgery fee, he would be on his way to Isabella. She wired him another $20,000. It was a lot of money to send, but she figured he was a good and honest serviceman – and if things worked out, they would spend the rest of their lives together.

Here’s how to identify this scam: Notice how the scammer:

- Professed he would marry Isabella quickly

- Claimed he was overseas for work

- Always had reasons why he needed to borrow money urgently

- Requested Isabella buy him gift cards

- Always made excuses to not visit Isabella

Here’s how to protect yourself from this scam:

- Refuse to buy gift cards or send money to people you’ve never met in person.

- Be careful how much personal information you share on social network sites. Scammers can use your information and pictures to create a fake identity or to target you with a scam.

- Be wary of people you meet online. Sometimes these scams can last for extended periods of time.

- Talk to friends or family about the people you meet on social media and notice if any concerns come up.

3. Work-from-home job scam

As Layla scrolled through her social media timeline, she saw an ad for a remote medical billing job.

The posting boasted of flexible hours and an opportunity to make $2,800 each month without any prior experience.

She contacted the company, Star Medical, and scheduled an interview for the same day.

“During the interview, there were normal questions about job history, but then there were questions about my Social Security number and where I have my checking account,” Layla said.

Layla got the “job,” and Star Medical mailed her a $3,500 check to buy equipment from a company they recommended. After she bought equipment from the website, there was $1,000 leftover. The company told her to send the rest of the money back via wire transfer.

Shortly after Layla sent the money back, her credit union told her the original check was fraudulent, and she actually spent $3,500 of her own money.

Here’s how to identify this scam:

- The recruiter asked Layla for personal and financial information during the interview. This information can be used to steal her identity.

- The job advertised high pay with no qualifications.

- The company sent Layla a check to purchase office equipment from someone they recommended and then wire the remaining funds back. This technique is often called an “overpayment scam.” The fake check may look real and appears to clear at first, but soon it bounces, typically after the victim has sent money to the scammer.

Here’s how to protect yourself from this scam:

- Never provide financial or personal information to recruiters or employers without ensuring they are legitimate.

- Do a background check of the prospective employer with the Better Business Bureau, Federal Trade Commission and Internet Crime Complaint Center at www.ic3.gov.

- If you have concerns that a check may be fraudulent, take the check and the accompanying letter to your nearest bank branch.

- Never agree to a wire transfer of any sort.

- Do not trust a recruiter who asks for money from you upfront in return for finding you a job or providing job leads.

4. Tech support scam

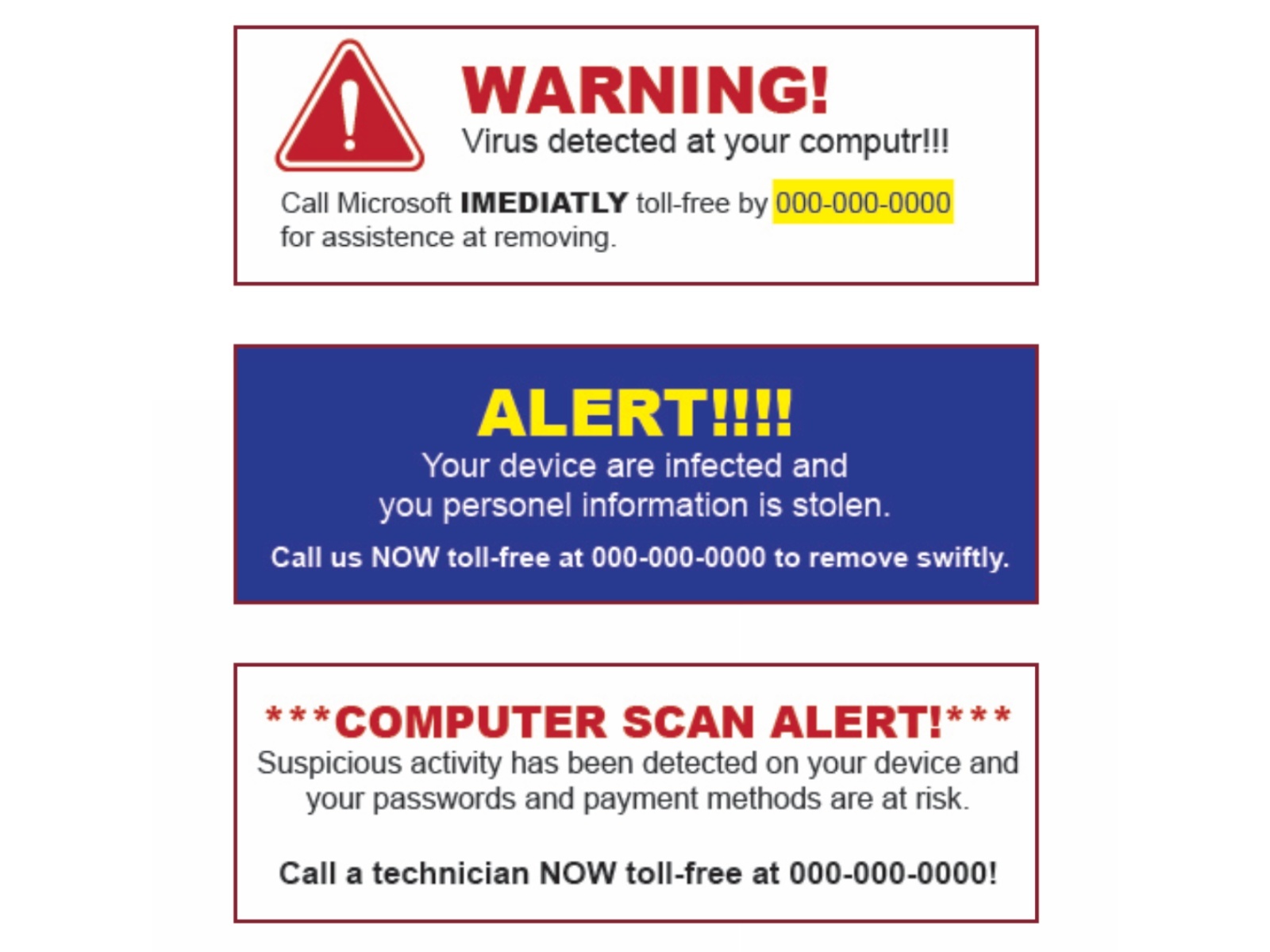

Julien was browsing on the internet one day and noticed a pop-up window.

The pop-up window notified him of a security threat on his computer and urged him to call the number on the screen immediately.

“The person on the phone told me they worked for a computer security company and they needed remote access to my computer,” Julien said. “They told me I had to install a remote access software, so that they could take over my computer and fix the issue.”

Once Julien downloaded the software, they took control of his computer and told him he had to pay $100 to get access back. Julien paid the fee, but they still had access to his personal files containing financial accounts, passwords and personal data (health records, Social Security numbers, etc.).

Here’s how to identify this scam: Once the phony tech support representative made verbal contact with Julien, they convinced him to download a remote access software so they could take over his device. Once they took over his computer, they would not release control until Julien paid the ransom.

Here’s how to protect yourself from this scam:

- Never download remote access software. Instead, if you think there may be a problem with your computer, phone or tablet, consult with someone you trust or take the device to a business that offers in person technical support.

- Do not call phone numbers on pop-ups. These phone numbers can connect you to fake security companies and even people pretending to be from your financial institution's fraud department.

- Examine pop-ups and emails closely for signs that might indicate fraud, such as spelling and grammar mistakes.

- Never provide your credit card or financial information to someone who calls and claims to be from tech support.